Best Tax Apps for Shopify

Are you looking for the best tax app for your Shopify store to make managing taxes for your store a seamless experience? Read on!

Although one of the most boring – and somewhat unrewarding – parts of running an online store on Shopify, managing taxes effectively is key to succeeding in e-commerce.

This is particularly true if you operate your Shopify store from the US, as failure to remit taxes to the government can get you into some serious trouble, which you definitely wouldn’t want. Of course, this is not to say that other countries are lax about consumption taxes, only that it’s more stringent in the US.

Managing consumption taxes for your store can be challenging. There are just many intricate tax rules you need to take into account, different types of taxes you need to be aware of, etc.

As such, attempting to handle taxes for your store manually can overwhelm you, hence why you need the best Shopify tax app.

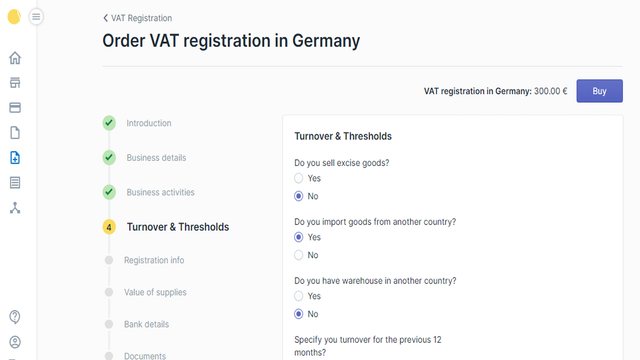

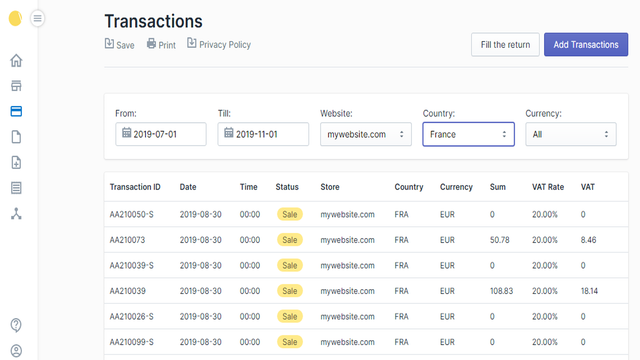

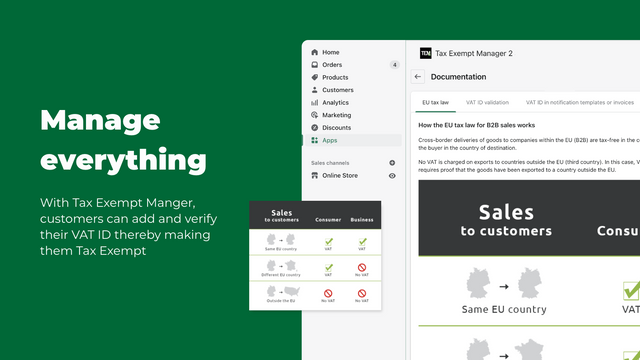

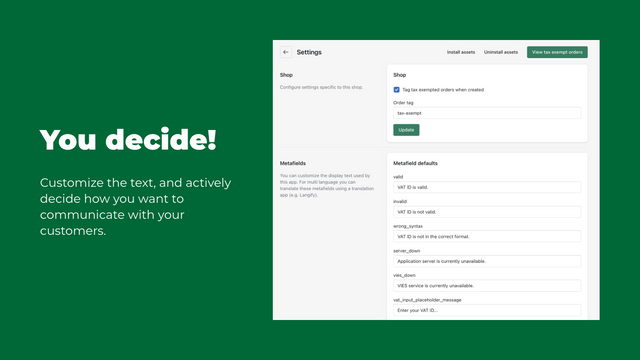

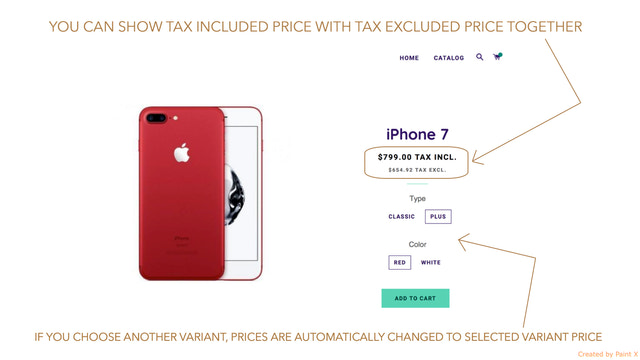

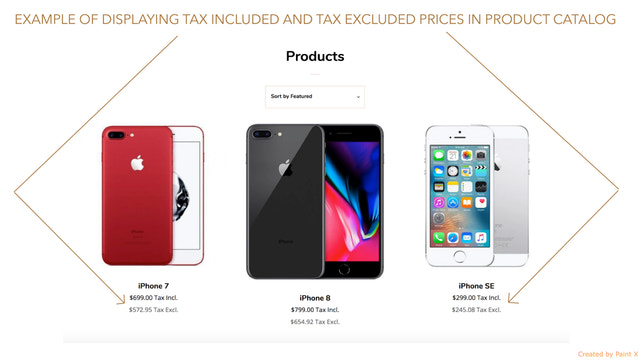

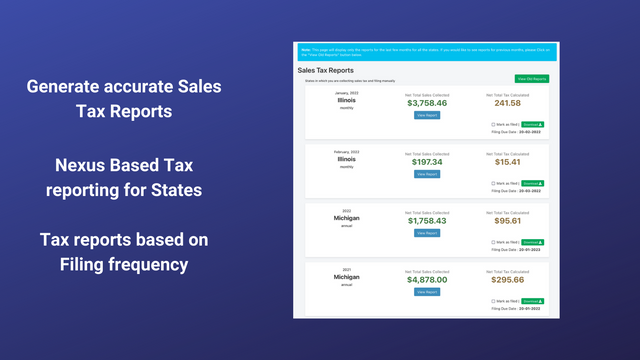

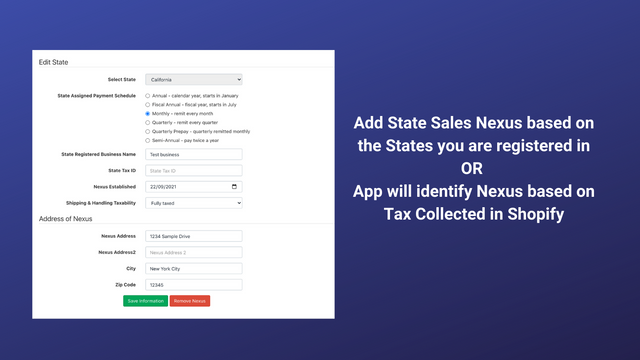

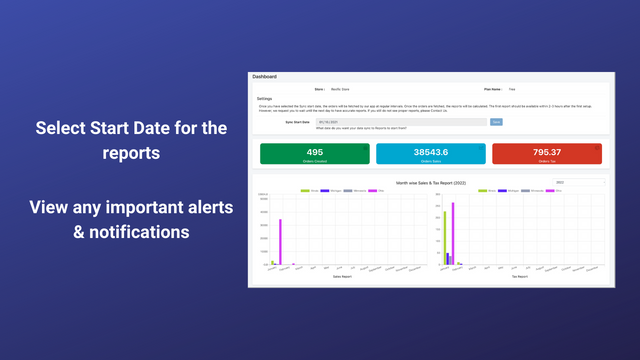

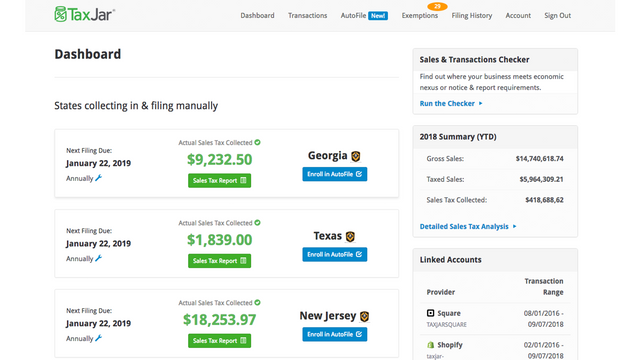

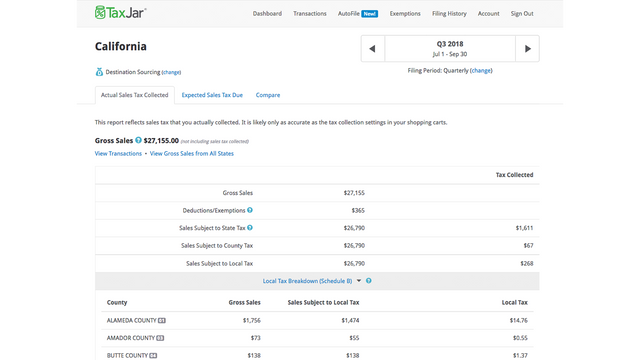

With these apps, you can conveniently track your expenses and income to have a clearer picture of your taxes, set up tax rules unique to the country/location you are selling to, add tax exclusions to certain products, generate tax reports that are easy to understand, and many more.

The coolest part is that most of the tax apps for Shopify are very easy to use and don’t require any expert skills. We’ve reviewed many of these apps in this roundup; we hope you found the one that fits your store best.