Starting and running any business, whether online or physical, requires capital. E-commerce businesses may not be as capital-intensive as physical ones, but you still need some funds to manage your business in most cases.

Some e-commerce business owners take out loans to finance their businesses. However, starting or supporting your business with a loan is hardly a good idea. Often, the high-interest rates on loans may take a while to pay off or hinder your business growth.

Reasons Why Borrowing A Loan Is Bad

Here are some reasons why you should avoid loans.

1. High-Interest Rates

Most loans, especially those from banks, have high interest on them. Paying off the interest on a loan and the seed money is not an easy thing to do. The terms of the loan may change over time, making it more difficult to offset.

2. It Could Affect Your Credit Score

When you take loans from banks and fail to repay the loan, it could reduce your credit score within a short period. A low credit score reduces your chances of getting other forms of financial assistance when you need them the most.

3. It Can Ruin The Relationship With Your Guarantors

If you involve a guarantor when taking a loan, it means the bank can confiscate their asset if you default in payment. When such happens, it strains the relationship between you and your guarantor, leaving you with no one to support you in future dealings.

7 Ways to Fund Your Shopify Business Without a Loan

Since we have established that borrowing is not the best way to raise funding for your Shopify business, the question you may be asking now is what other financing options can you try. Below are seven alternative ways to fund your Shopify business without a loan in 2024.

1. Bootstrapping

Bootstrapping is one of the most common e-commerce financing options. It involves funding your Shopify store with your personal savings and business revenue. Many small business owners leverage this funding method because it gives them absolute control over their businesses and finances.

Bootstrapping helps you avoid taking out loans with high-interest rates. If done right, it is an excellent way to scale your business, especially at the start.

For instance, Shopify founders bootstrapped the platform for six years before eventually opting for venture capital funding.

2. Through Family and Friends

Yes, you heard right. You can contact your close friends and family to solicit funding for your e-commerce business. The fund you receive from family and friends can be interest-free, and you have a more extended grace period to pay back. While sometimes, you don’t have to repay.

Some small business owners often fall back on the support of family and friends when bootstrapping fails. However, you must apply caution if you decide to go down this route. Ensure you repay the funding when the time comes in order not to strain your relationship.

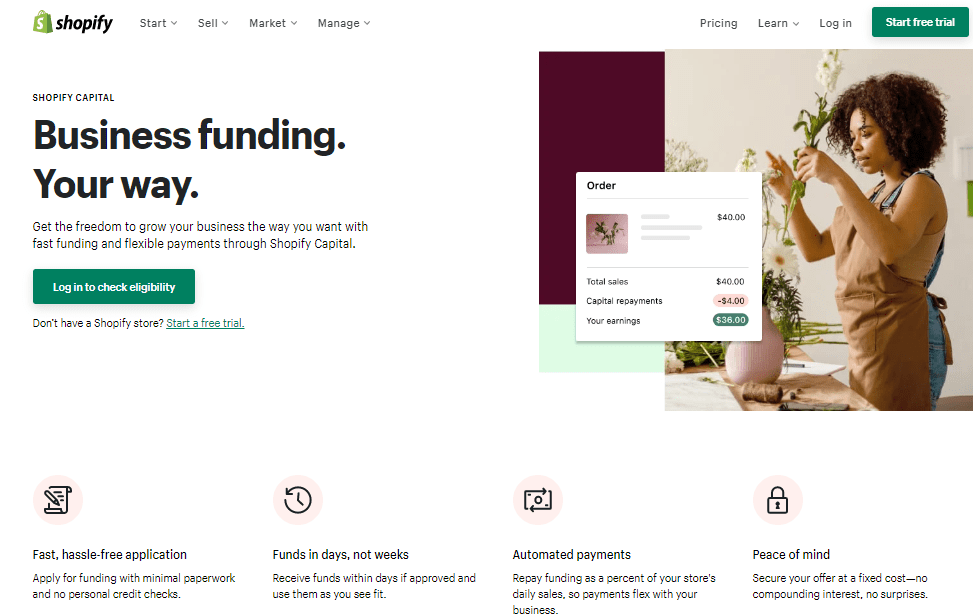

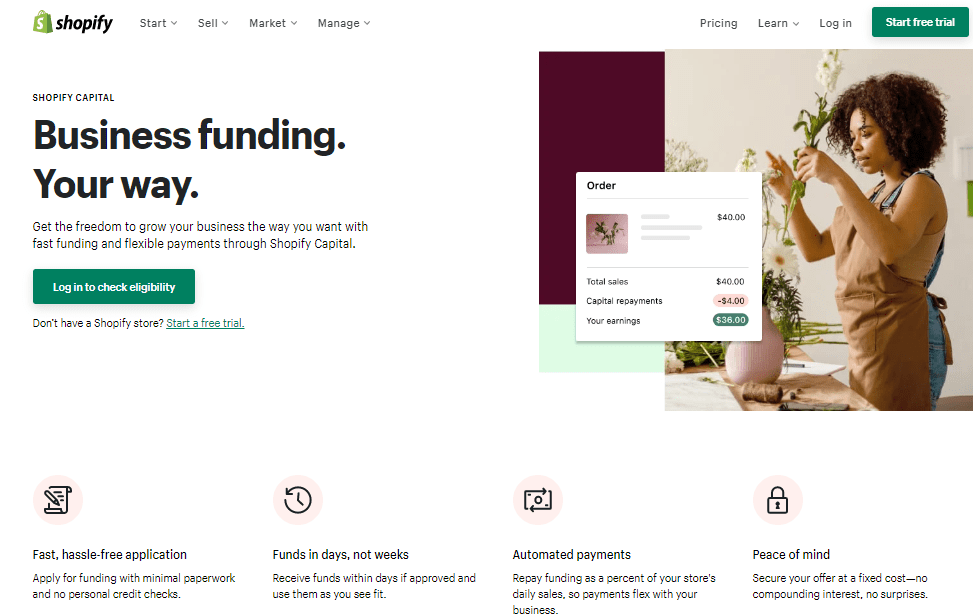

3. Shopify Capital

Shopify launched a capital lending program for its users in 2016 called Shopify capital. How does it work? When you receive the fund, Shopify automatically deducts a certain amount from your daily sales to repay the fund. To apply for Shopify capital, you must have a Shopify store, be considered low-risk, have a payment provider, and reside in the UK, US, or Canada.

Shopify Capital is a great way to access additional funding for e-commerce businesses without loans. The application process is easy and fast. And you can pay off the fund daily and not worry about compound interest.

4. E-commerce Venture Capital

Venture Captial is another way of getting e-commerce startup funding for small businesses. It is a form of financing where individuals, known as angel investors, provide funding for startups in exchange for equity. Most venture capitalists target startups at their early stage that has the potential to grow.

Venture capital also gives you access to a network of investors that can help boost your business in addition to funding.

However, one criterion for receiving a venture capital fund is to give up a part of your business and the sole right to make decisions. Meaning that the investors have a say over your business activities. If you don’t mind these, venture capital could be what your Shopify business needs to scale.

5. Crowdfunding

Crowdfunding is another method to fund your Shopify business. It involves raising funding from the public in exchange for exclusive products and services. In most cases, you retain 100 percent control over your business. However, some crowdfunding groups may demand equity, but it is not a common practice.

If you want to try out the crowdfunding method, you can visit websites like Indiegogo, GoFundMe, and Kickstarter.

One perk of using Crowdfunding to raise capital for your business is early promotion. People will get to know about your business and what you offer before you launch. So if your business model impresses the public, you can record an outstanding performance in the early stages of your business.

However, you risk attracting competitors or a negative PR since your business model is available to the public.

6. Grants

Another way to finance your Shopify business is through grants. Grants are business funds you receive without the expectation to pay them back. In other words, they are free money. Some individuals and organizations offer to help small business owners expand their businesses by giving them grants.

Although investors do not request that you repay a grant, getting it takes much effort, time, and commitment. Your business model and strategy must be convincing. And you have to meet the eligibility requirements before applying for one.

You can apply for grants under several categories, such as nationality, business type, gender, and so on. The grant price can be as low as $500 and as high as $500,000, depending on the source and purpose.

7. Revenue-Sharing Financing

If none of the funding methods we’ve shared so far looks practicable to you, try the revenue-share method. This method uses advanced technology to analyze a business and create multiple offers based on the business’s performance.

As a business owner applying for this type of funding, your revenue data determine your eligibility and how much find you can access.

The good thing about this type of funding is that it is easy to access.

Revenue-share is an excellent e-commerce financing option for small businesses as it focuses on the profitability of your business and not who you know. Also, you get to retain total control of your business and decision-making.

Several Shopify accounting apps can help you calculate your revenue accurately if you want to opt for this type of e-commerce startup funding.

Final words

If you want to retain complete control over your business, avoid borrowing a loan and look for e-commerce financing options that do not demand equity. It is always better to finance your business without a loan, especially at the beginning.

Lucky for you, we’ve shared some tried-and-true funding options you can leverage to fund your Shopify business.

Still struggling to generate sales for your business? Adoric can help.

Adoric has many tools and features designed to help you convert your website traffic into sales and subscriptions. Add Adoric to your Shopify website right away to take it for a spin.